Wealth transition advisory services

We work with family-owned, privately held businesses and individuals to support successful generational and wealth transitions.

What EY wealth transition services can do for you

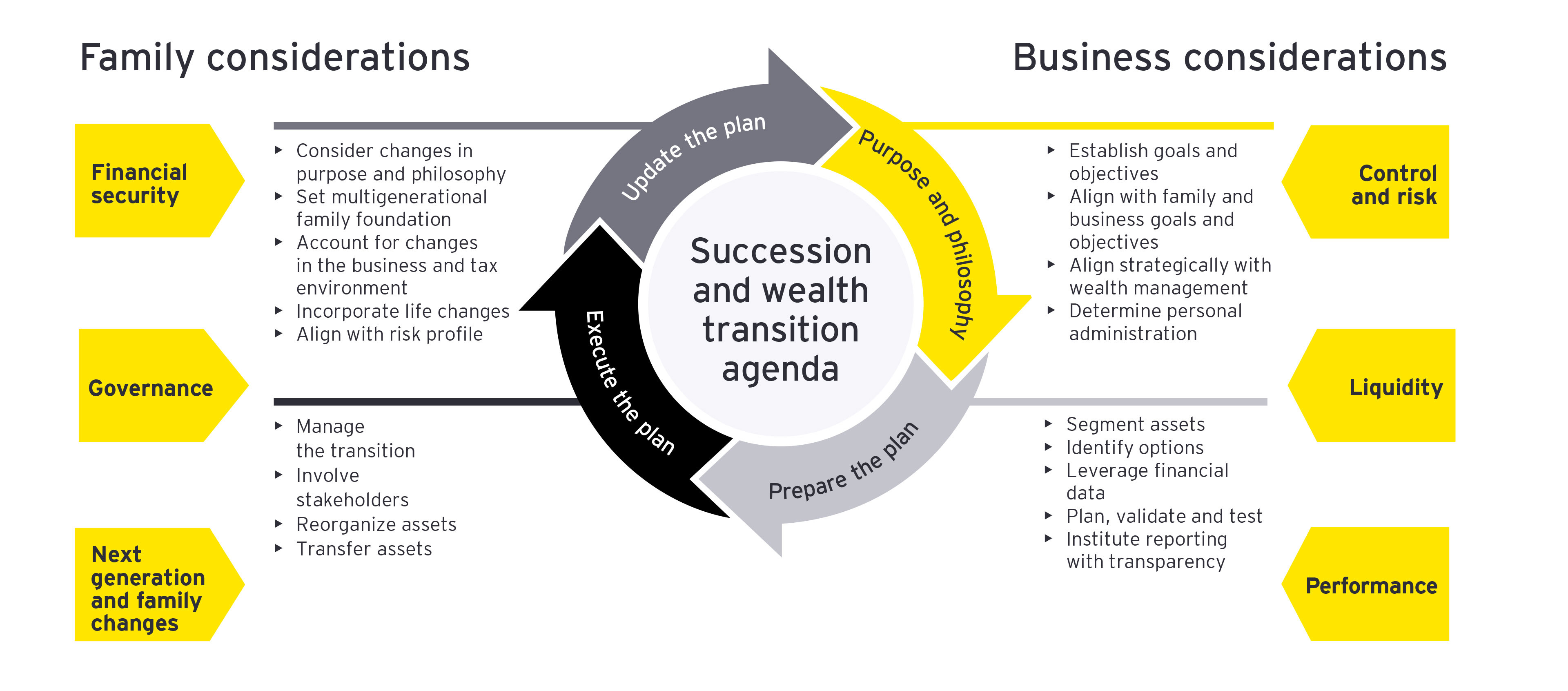

Will the real value of your wealth endure? The EY process-driven approach to wealth transition and succession planning can support you and your family in securing your assets for many generations to come. This process considers external family factors (financial security, governance and next-generation and family changes) and business factors (control and risk, liquidity and performance) that influence a wealth transition plan.

Our service is a three-phase approach to guide you in designing and implementing that plan, followed by a fourth phase to support you through monitoring and recalibrating the plan for changes that may occur tomorrow and in the future.

Phase I: purpose and philosophy

Understand the current plan, if one is in place, and develop the vision, goals and objectives of the owner and family.

Phase II: prepare the plan

Use an iterative process of design sessions to align the goals of the family with planning options using data and reporting to outline a blueprint for implementation.

Phase III: execute the plan

Assist in creation of comprehensive structure and entity design, financial modeling, implementation and complete documentation of the plan.

Phase IV: update the plan

Develop a system for monitoring the plan on an ongoing basis, which includes both life and business events, as well as regular touch points, including transactions that need to be dealt with on an annual basis.

Common wealth transfer issues we address:

- Lack of formal estate plan or understanding of current estate plan

- Lack of communication of estate plan to key stakeholders

- Not enough liquidity to pay estate and gift taxes

- Estate plan that is outdated or no longer relevant

- Planning for assets outside the business that are unprotected

- Concern over expectations of active and inactive family members regarding the family business:

- Cash flow

- Control

- Ownership that is no longer effective

EY dedicated wealth transition teams and global experience

Ernst & Young LLP has the global experience, knowledge and extensive network to support clients and their unique wealth transition needs. Our global organization is a market leader in serving family businesses.

Our EY Private Tax practice includes a national team and network of more than 100 professionals dedicated to wealth transition planning with in-depth tax technical knowledge. Many of our professionals have previously served as executives in family enterprises and family offices, insurance professionals, attorneys and investment advisors.

Wealth transition planning in a time of uncertainty

Planning for potential estate tax changes.

Wealth transition planning with SPACs

Navigate the complexities of gift planning with SPAC assets.

Wealth transition planning for 2021 and beyond

The change in Congress could impact wealth transition planning.